nevada estate tax rate 2021

It is one of the 38 states that does not apply an estate tax. Delaware repealed its estate tax at the beginning of 2018.

Taxes In Nevada U S Legal It Group

For more information contact the Department at 775-684-2000.

. Rates include state county and city taxes. Washington estate tax rate 2021 Up to 2193000. The Nevada income tax has one tax bracket with a maximum marginal income tax of 000 as of 2022.

Value of estate. Select Popular Legal Forms Packages of Any Category. NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes.

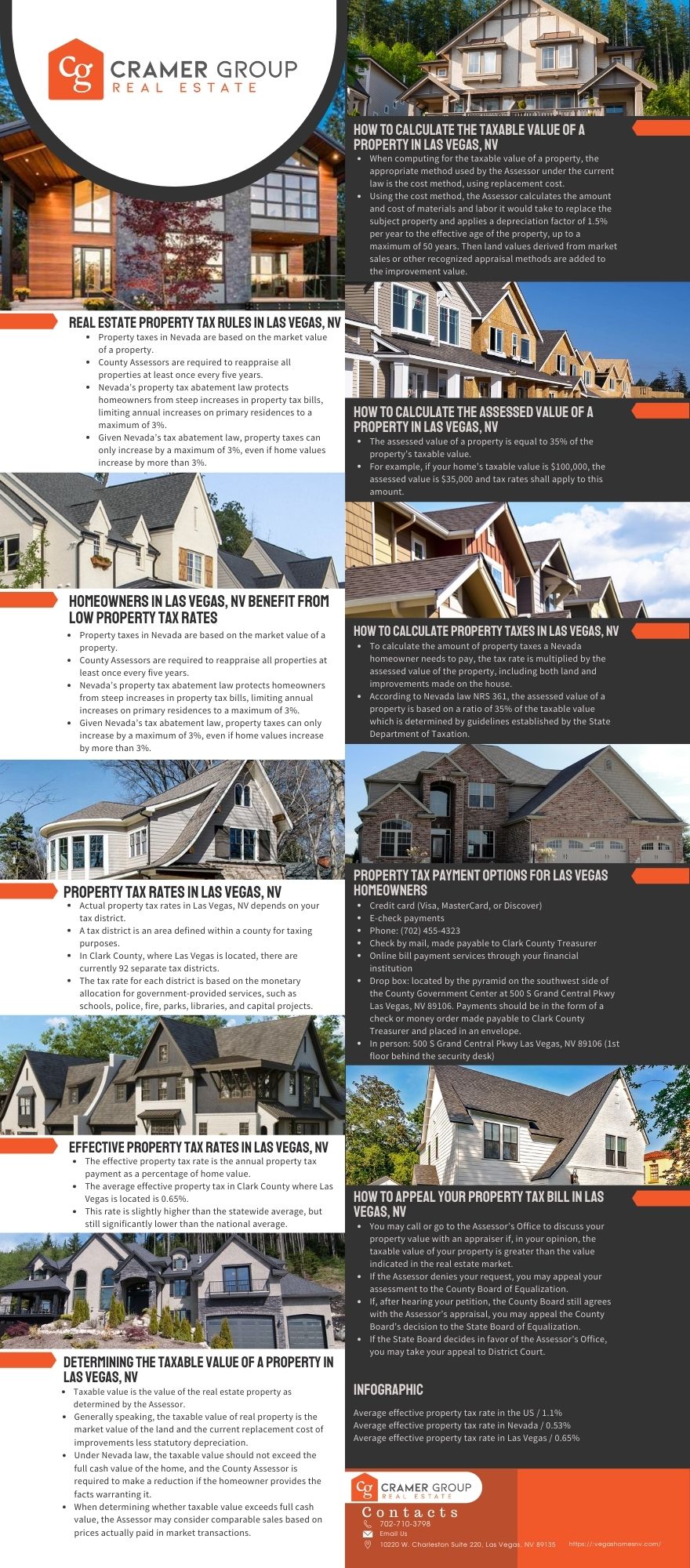

Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of Nevada. Over 3193000 to 4193000. Assessed value is equal to 35 of that taxable value.

You may find this information in Property. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Nevada estate tax exemption 2021.

Clark County Tax Rate Increase - Effective January 1 2020. Nevada estate tax exemption 2021. Tax rates apply to.

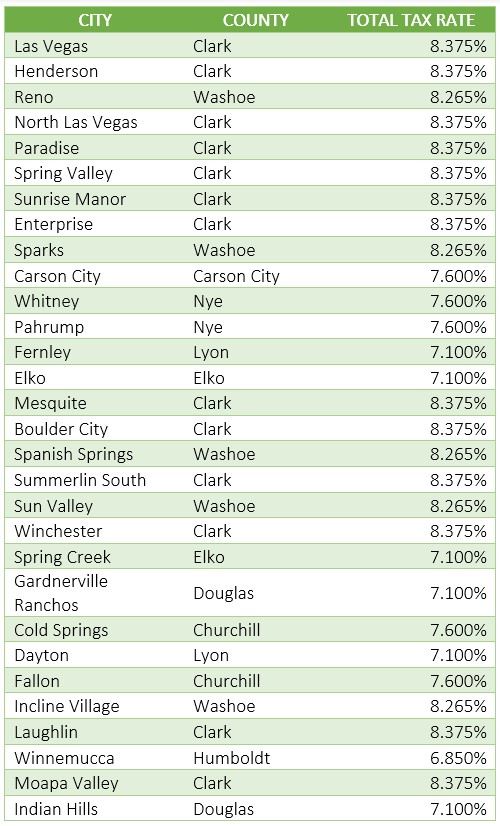

All Major Categories Covered. So even though Nevada does not have an estate tax gift tax or inheritance tax it does not mean that. 31 rows The latest sales tax rates for cities in Nevada NV state.

Nevada does not have a corporate income tax but does levy a gross receipts tax. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax Credit Nevada that was collected prior to January 1 2005. In 2022 it rises to 1206 million.

To calculate the tax multiply the assessed value by the applicable tax rate. This cle webinar will provide guidance to trusts. Counties in Nevada collect an average of 084 of a propertys assesed fair.

Ad From Fisher Investments 40 years managing money and helping thousands of families. Some states also have estate. The tax rate ranges from 116 to 12 for 2022.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. But Nevada does have a relatively high sales tax a state rate is around 7 but goes to approximately 8 when you consider local tax rates.

Nevada repealed its estate tax also called a pick-up tax on Jan. 2020 rates included for use while preparing your income tax. New Jersey finished phasing out its estate tax at the same time and now only imposes an inheritance tax.

The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. The rate jumps to 15 percent on capital gains if their income is 40401 to 445850. Nevada has a 685 percent state sales tax rate a max local sales tax rate of 153 percent and an average.

Detailed Nevada state income tax rates and brackets are available on this page. 2021 Nevada State Sales Tax Rates The list below details the localities in Nevada with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Low rates and high inflation make cash.

70000 assessed value x 032782 tax rate per hundred dollars 229474 for the fiscal year. Any sales tax that is collected belongs to the state and does. In 2021 federal estate tax generally applies to assets over 117 million.

The estate tax rate is based on the value of the decedents entire taxable estate. Starting in 2023 it will be a 12 fixed rate. Thus if your County Assessor determines your homes taxable value is 100000 your assessed value will be 35000.

Nevada currently does not have an estate tax. Estate tax rate ranges from 18 to 40. Over 2193000 to 3193000.

There are two kinds of taxes. In 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or less.

City Of Reno Property Tax City Of Reno

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Nevada Vs California Taxes Explained Retirebetternow Com

Taxes In Nevada U S Legal It Group

Image Result For U S National Map Of Property Taxes Property Tax American History Timeline Usa Facts

Nevada Income Tax Calculator Smartasset

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Taxpayer Information Henderson Nv

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Taxes In Nevada U S Legal It Group

Nevada Property Tax Calculator Smartasset

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Nevada Tax Advantages And Benefits Retirebetternow Com

Taxes In Nevada U S Legal It Group

Taxpayer Information Henderson Nv

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

Nevada Property Tax Calculator Smartasset