calhoun county alabama delinquent property taxes

Parcel Viewer Mobile Friendly Other County Mapping Sites. Calhoun County Revenue Department Parcel Viewer Site.

Hamblen County Tennessee Property Taxes 2022

1975 40-10-180 through 200 the Calhoun County Tax Collecting official has authority to auction and sell tax liens on.

. Please call 251 344-4737 To report non-filers please email taxpolicyrevenuealabamagov Contact 50 N. Delinquency notices are mailed. Good news - You dont have to wait for the annual tax.

Montgomery AL 36130 Contact Us. Call 844-729-4468 to pay over the. In Calhoun County Alabama real estate property taxes are due on October 1 and are considered delinquent after December 31st of each year.

Within 45 days of delinquency the Tax Collector is required to. 315 W Green St Marshall MI 49068 269-781-0700. The median property tax in Calhoun County Alabama is 399 per year for a home worth the median value of 98200.

The Calhoun County Tax Collection Department notifies the property owner and is responsible for collecting the correct tax for each parcel of land. Overage Listings by Year The following documents contain overage listings by year and are. Delinquent taxes cannot be paid online.

There are service fees associated with paying online. Calhoun County collects on average 041 of a propertys. All unpaid tangible personal property becomes delinquent on April 1 each year with a 15 penalty added each month.

Explore how Calhoun County applies its real property taxes with our in-depth overview. Delinquent taxes are for inquiry purposes only. Pay Delinquent Taxes Online.

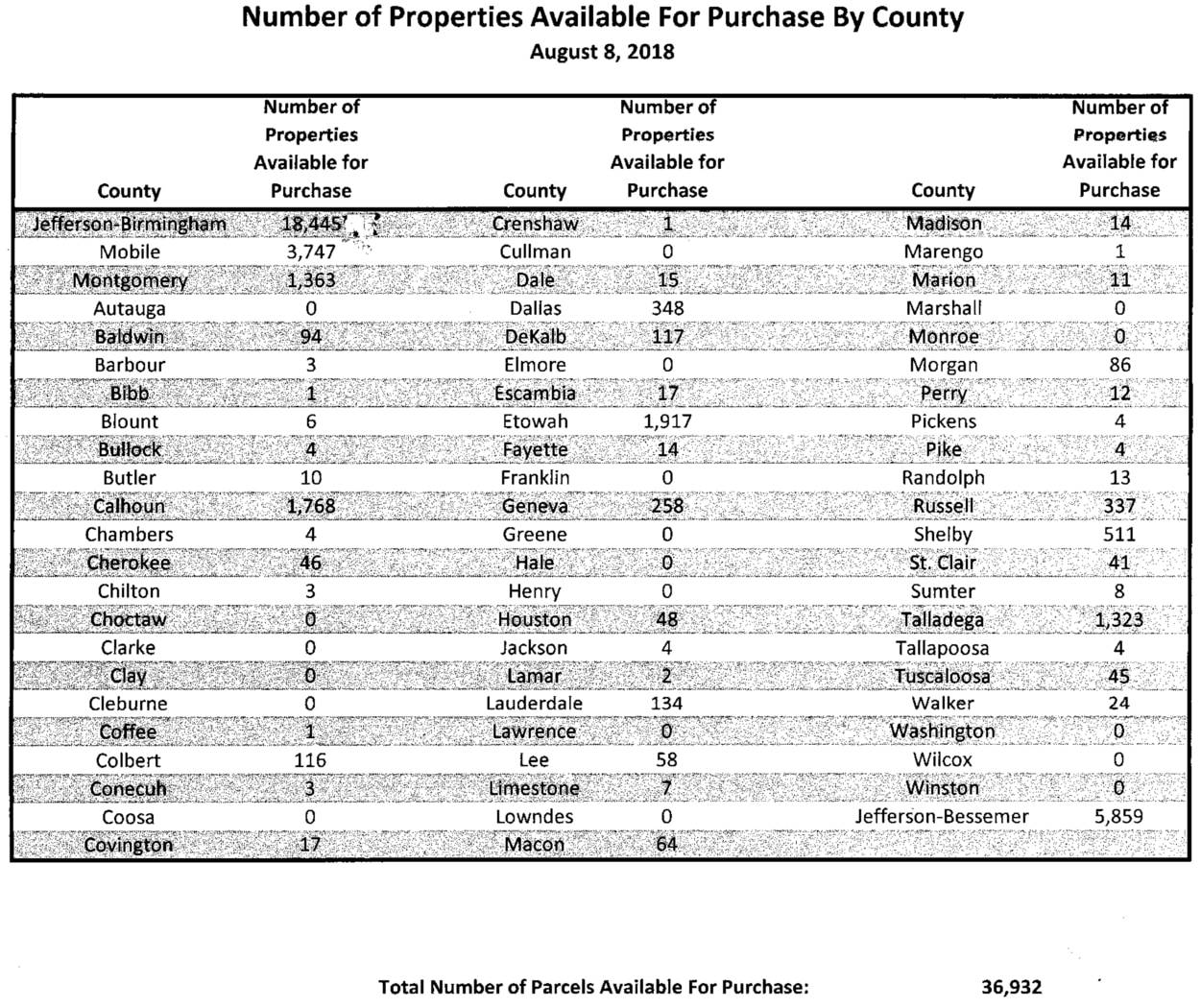

Interested in buying tax properties in Alabama now. Pay Delinquent Taxes Over the Phone. The 2022 Alabama Tax Auction Season completed on June 3 2022.

If you have any questions please contact Delinquent Tax office at 803-874-4021. IN ACCORDANCE WITH CODE OF ALABAMA TITLE 40-10-182 THIS NOTICE IS TO INFORM YOU OF A TAX LIEN AUCTION. Taxes are due at the end of each tax year.

Click here to pay online. These site allow you to enter your address and have it looked up using. County Information Welcome to the Calhoun County Tax Payment Website.

About Us learn more Look Up. Skip to main content. Text Size Increase font size.

If you are currently living here just thinking about taking up residence in Calhoun County or. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Calhoun County AL at tax lien auctions or online distressed asset. In accordance with Title 40 Chapter 10 Code of Ala.

Tax Delinquent Properties for Sale Search You may search for transcripts of properties currently available by County CS Number Parcel Number or by the persons name in which the.

A Tax Deed Is Not The Same As A Title Alabama Real Estate Lawyers

Feb 16 2018 Alex City Outlook By Tallapoosa Publishers Issuu

User Jerricka Tax Policy In Alabama Ballotpedia

How To Find Tax Delinquent Properties In Your Area Rethority

Legal Notices For The Week Of April 7 14 2017 And Delinquent Tax Notifications Gadsden Messenger

Clipping From The Anniston Star Newspapers Com

Calhoun County Alabama Public Records Directory

Alabama Property Tax Calculator Smartasset

Calhoun County Online Services

Dallas County Tax Delinquency List News Selmasun Com

Homestead Exemptions Alabama Department Of Revenue

Homestead Exemptions Alabama Department Of Revenue

State Land Bank Authority Holds Organizational Meeting

80 Murphee Ln Anniston Al 36201 Mls 1324316 Zillow

Homestead Exemptions Alabama Department Of Revenue

The Anniston Star From Anniston Alabama On April 21 1996 Page 46